The problem

Your FP&A team has moved past chaos. Month-end closes happen. Reports get produced on schedule. Forecast models exist. From the outside, it looks functional.

But you're plateaued, and everyone feels it.

The team spends most of their time maintaining the reporting machine instead of generating insights. Business partners come to you for numbers, not strategic guidance. The forecast exists but misses by enough that executives don't trust it to guide real decisions. When executives ask questions, your team describes what happened but struggles to explain why it matters or what to do differently.

You see the pattern everywhere:

Capacity trapped in mechanics. The team is working hard but but executives aren't finding it valuable.

No strategic influence. Finance is informed after decisions are made.

Improvements don't stick. Every initiative feels like pushing a boulder uphill - progress made, then lost.

What's missing isn't effort or budget or intelligence. It's a comprehensive operating system that drives value.

The FP&A Operating System™

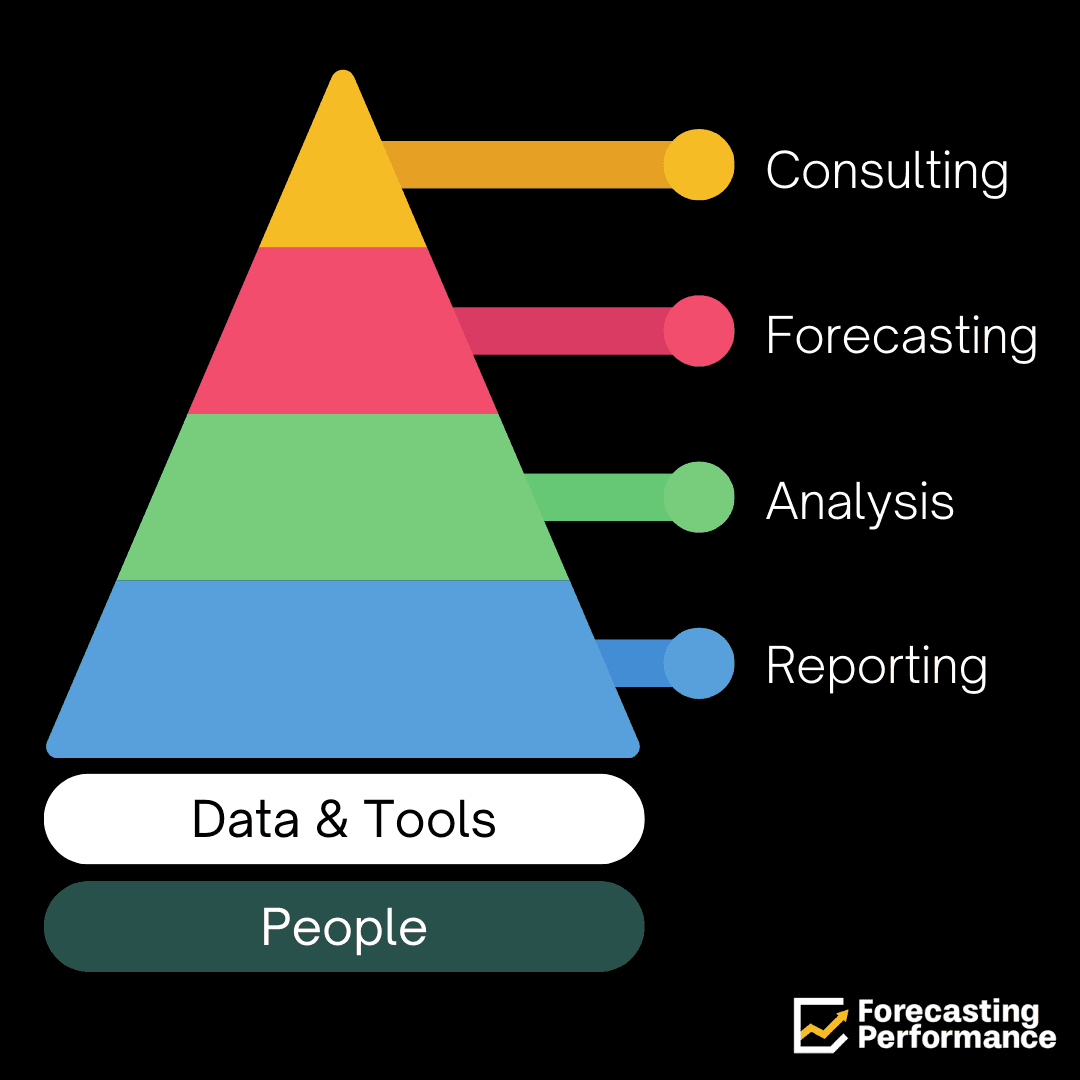

Over 13 years leading FP&A teams at Fortune 100 companies and PE-backed businesses, we developed a complete operating system for building world-class finance functions. It's the framework we use to flip teams from 80% reporting / 20% analysis to the inverse. To cut analysis outputs from weeks to days. To reduce forecast variance from 15% and ignored to under 5% and relevant. To earn finance a permanent seat at strategic planning.

The FP&A OS has six interconnected pillars. Most teams focus on one or two in isolation - they buy a forecasting tool or hire better analysts - and wonder why nothing changes. Real transformation requires systematic progress across all six.

The FP&A Transformation

A clear, CFO-led path

We implement the specific FP&A Operating System frameworks that move your team up the maturity curve. Structured, measurable, and designed for finance leaders who need proven systems, not experiments.

Why CFOs trust us

Real Implementations, Real Outcomes

CFOs come to Forecasting Performance not because they lack data, tooling, or capable teams — but because finance still isn’t delivering decision-grade clarity.

Reports are produced. Dashboards exist. Forecasts are updated.

Yet uncertainty remains, assumptions aren’t surfaced clearly, and the same questions reappear cycle after cycle.

Our work is informed by leading finance in high-expectation environments — from PE-backed operators to complex, multi-stakeholder organizations. Across these contexts, the issue is rarely technical. It’s structural.

Forecasting Performance applies a higher standard.

Finance is evaluated by signal quality, not output volume.

Forecasts are judged by reliability, not effort.

Analysis is expected to explain drivers, not just variance.

The result is trust — in the numbers, in the underlying assumptions, and in the decisions finance enables leaders to make.